How to Read Coefficients of Utilization Table

If you desire to keep upward with loan payments, specially when information technology comes to a stock-still-interest loan, using an amortization table can be incredibly helpful. Non just tin can a loan amortization table help you keep up with your monthly payments, only information technology's as well cracking for understanding your involvement costs as the loan rest decreases. Not familiar with how an amortization table works? Don't worry — we'll walk yous through how to brand, read, and utilize 1.

What Is an Amortized Loan?

An amortized loan is a type of loan with scheduled payments that go toward paying off both the loan's chief amount and interest. Most types of loans that you pay back on a monthly basis tend to be amortized loans — call back car, home equity, and personal loans. Another great example of this type of loan structure is a fixed-charge per unit mortgage.

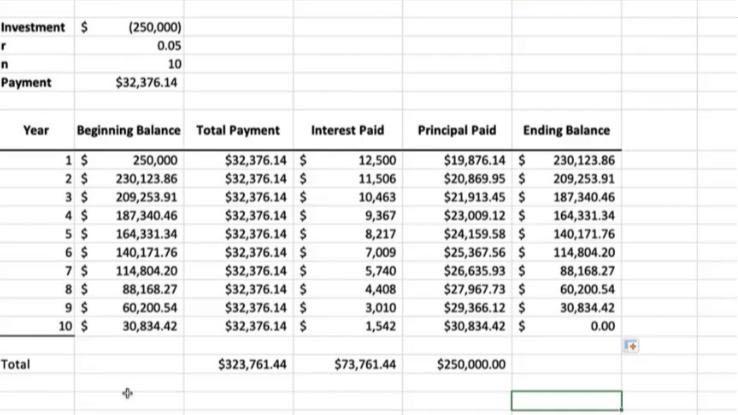

When you make monthly payments on an amortized loan, role of your payment goes to paying off interest, while the rest goes towards paying off your principal. An amortization tabular array is a handy style to calculate how much of your monthly payment is going to each category, especially since this ratio will alter as your total balance decreases.

The boilerplate amortization table calculates several things, including:

- Monthly Balance: This cavalcade keeps a tape of your full remaining balance.

- Monthly Payment: If yous have a stock-still-rate loan, this column will likely include the same payment amount each month. Once you make your payment, y'all'll exist able to decrease it from the monthly balance.

- Interest Paid: This is where y'all'll see how much of your monthly payment is going toward the interest. In order to find this figure, multiply your remaining loan remainder by your monthly involvement charge per unit.

- Principle Paid: Once you figure out how much of your payment went toward paying off involvement, subtract that number from the unabridged payment you lot made. The remaining money will exist the amount that went toward your principal.

- Remaining Rest: This is the new monthly remainder you'll start with for the next month's payment. In other words, subtract your payment from the former monthly residual to find the new remaining remainder.

When you lot first start making payments, you'll discover that your interest costs are at their highest. As y'all brand more payments, however, there volition exist less and less main to charge involvement on. In plough, you'll notice that a piffling more than of your payment will go toward paying off your principal.

Making your own amortization chart using Microsoft Excel, or even using an Excel loan payment template, tin can be a great, firsthand way to see how it all works. There's even a free website chosen amortization-calc.com that's able to exercise the math for you lot, then long equally y'all input your loan type, amount, involvement rate, and term.

In addition to helping you look ahead to future payments, an acquittal nautical chart tin come in handy before yous even accept out a loan. For example, while it may initially seem similar making the lowest possible payment every month is the way to get, a loan amortization calculator may tell a different story. That is, in some cases, past paying less each month — or selecting a longer repayment term — you may finish up paying far more interest in the long run.

Then, earlier settling on repayment terms, try running a couple of options through an acquittal table to see what volition yield the all-time rate overall. This strategy can besides help you lot determine whether refinancing a loan or, if possible, paying it off early is the way to get.

Loans That Exercise and Don't Work With an Amortization Chart

Every bit helpful as an amortization loan chart tin can exist, it can non be used in conjunction with every type of loan. That is, these tables only work when forecasting installment loans or fixed-rate loans that allow y'all to pay down the balance over fourth dimension.

Loans that will not fit into an amortization table include the following:

Interest-Only Loans: Nearly mortgages are amortized loans, but others work in dissimilar ways. Interest-just loans, for instance, only require you to pay the interest on the loan for a certain amount of time. This is great during the initial period when only the interest is due, every bit it results in much lower payments. What you have to keep in listen, however, is that you're not paying off your principal at all during that time. Eventually, the interest-only period will come to an end and you'll be expected to either pay off the loan completely or start making much higher payments that encompass both the principal and interest.

Balloon Loans: Airship loans are like to interest-but loans in that they're fun while they concluding. This is the kind of loan you'll only want to take out if you're expecting a huge payment at some point in the future. The monthly payments for balloon loans outset out pretty small, simply then, at some point, yous'll be expected to either pay off the loan completely in a lump sum or refinance it, which isn't always a stable option. For example, many people lost their homes in the mortgage crisis of 2008 by counting on the refinancing option.

Revolving Debt: Revolving debt is the type you become into when you lot use credit cards. Because you get to choose how much you borrow and pay back each month, the main isn't e'er likely to stay the same, fifty-fifty if the interest charge per unit does. The only fourth dimension you'd be able to utilize an acquittal table to pay off this type of debt would be if you decided to no longer use the credit bill of fare anymore and dedicated yourself to merely paying it off. Even and so, all the same, information technology would only work if your involvement rate never changed.

Source: https://www.reference.com/business-finance/loan-amortization-table?utm_content=params%3Ao%3D740005%26ad%3DdirN%26qo%3DserpIndex

0 Response to "How to Read Coefficients of Utilization Table"

Post a Comment